RISK MANAGEMENT

Manage risk efficiently

Optimize your company's operational and market risk policy and keep the transaction cycle under control with a single system.

Why VMetrix is the best choice for your Risk Management team?

Discount curves always up to date

Access from the same platform to discount curves to value your investments and get an accurate valuation of your

assets through the Mark to Market.

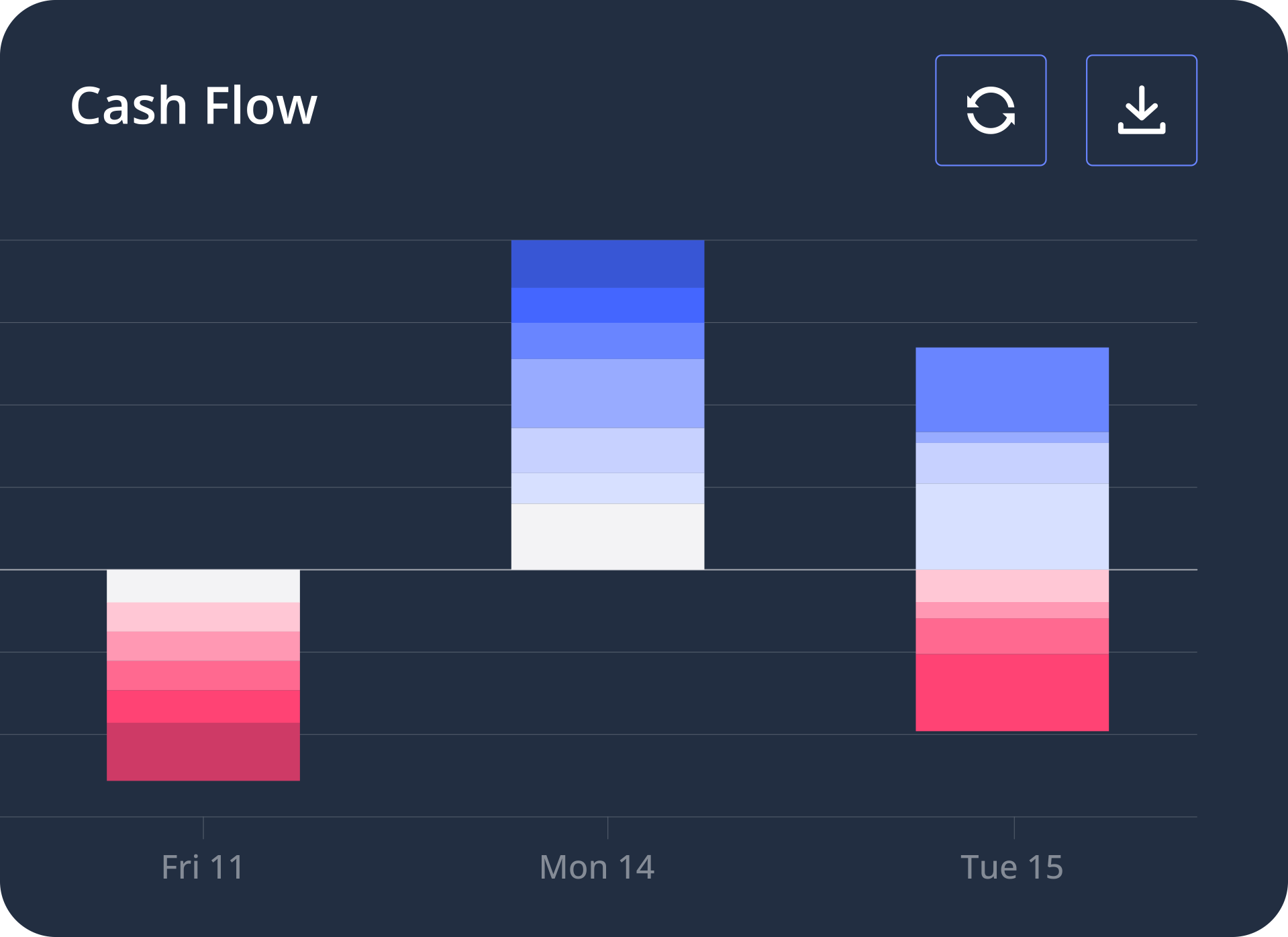

Sensitivity analysis and value at risk

Analyze the sensitivity of your portfolios with metrics such as

Delta, Duration and Convexity and use Value at Risk to estimate

losses using different confidence levels.

Enhance the value of your portfolios

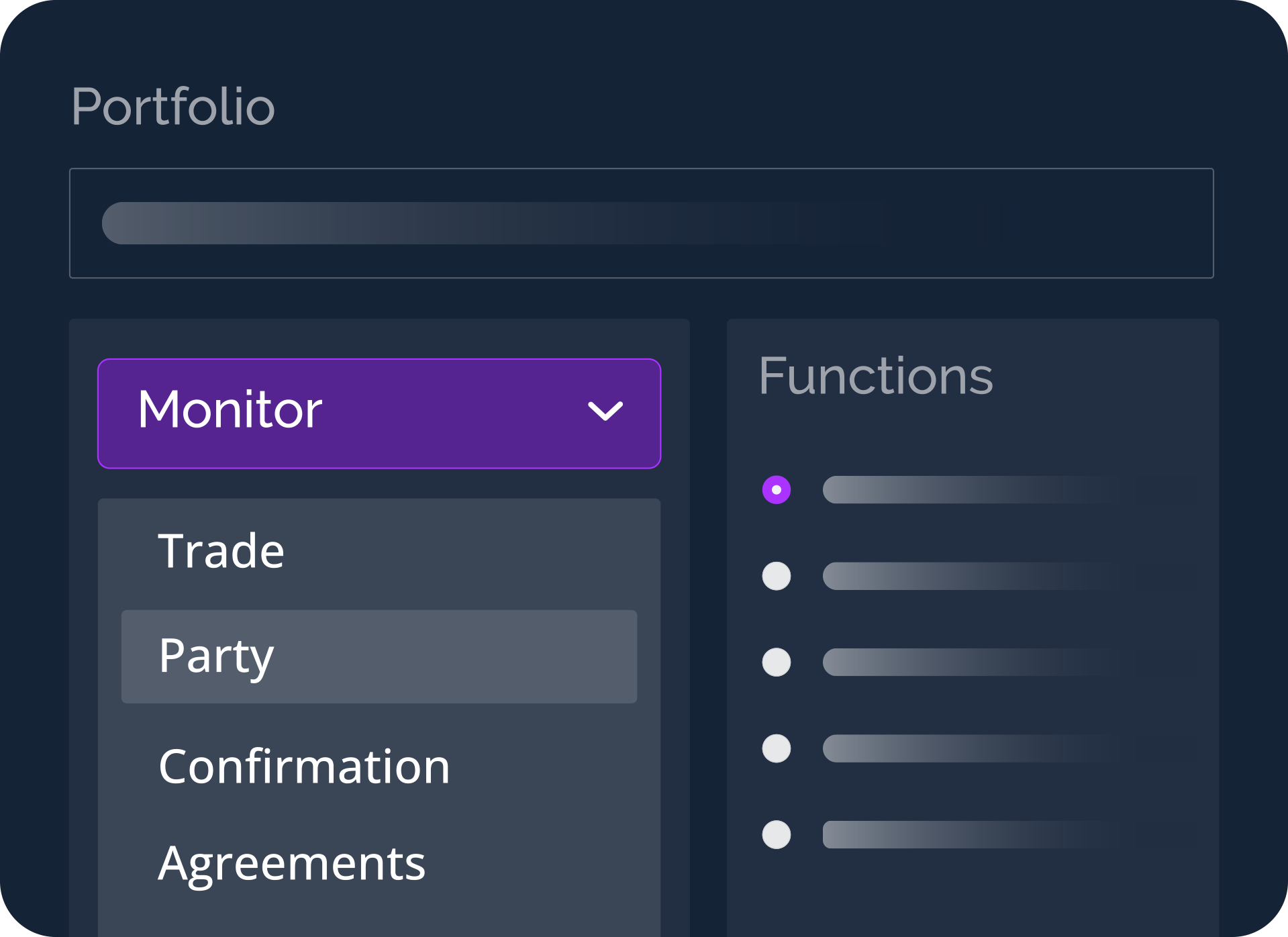

Control your portfolios in minutes

Choose your own risk limits

Simulation of events and operations

Replicate volatility scenarios to analyze how your portfolios would be affected and simulate trades to understand their impact, without the need to commit the counterparty.

Forecast and discount rates

Consult reference rates preloaded in the platform, such as

the SOFR rate, and analyze how they influence the overall risk management of your portfolios.

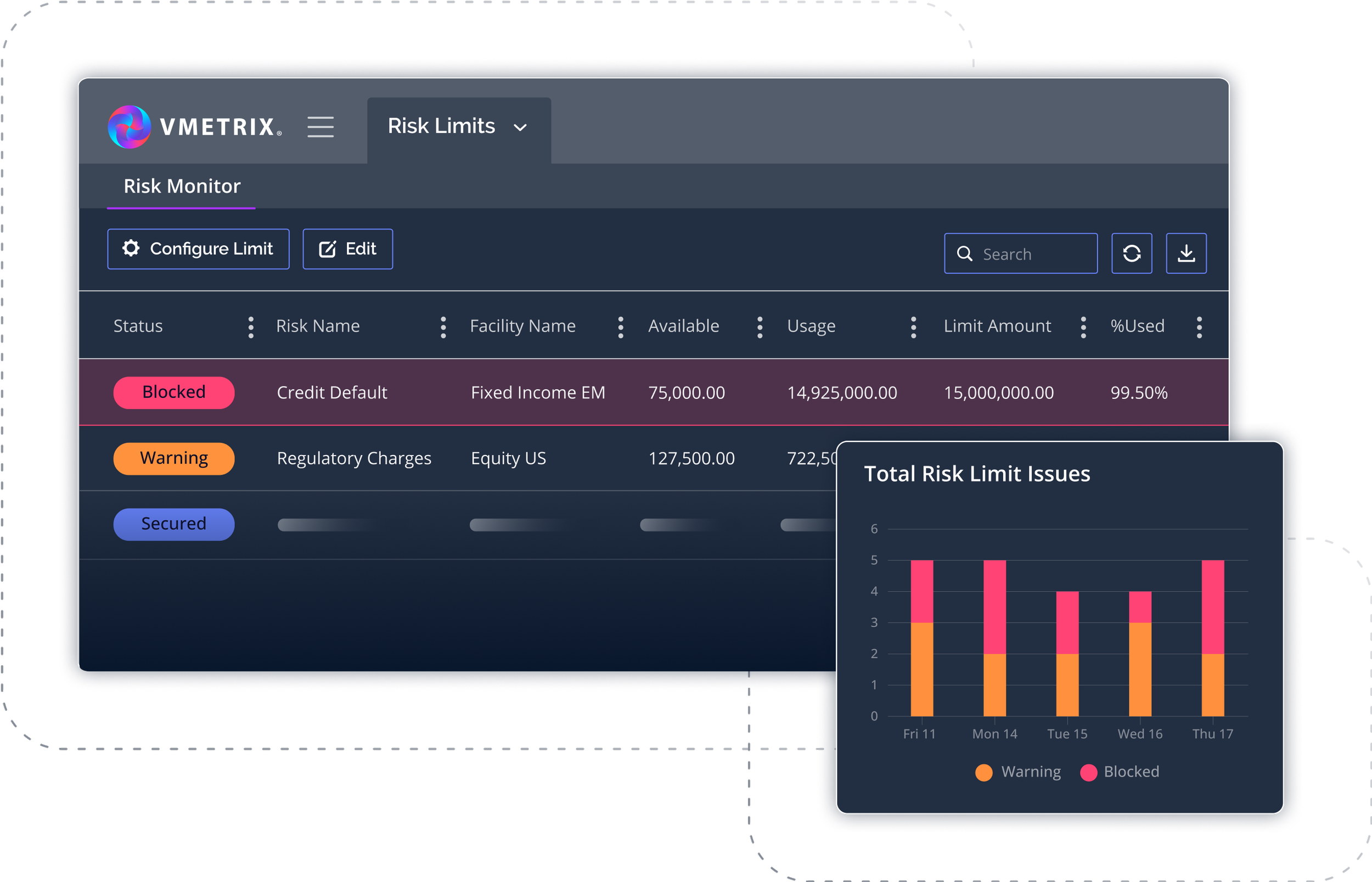

Customizable limits

Configure specific limits for each of your portfolios

or use the risk limits that are preconfigured in the platform and adapt them according to your needs.

Audit and control

View and download a detailed record of each process that

runs on the platform, to improve internal control and

easily comply with external regulators.

Manage the complete lifecycle of your portfolios on one platform

Find out how VMetrix can be used by the rest of the teams in your company.

-

Trade multiple assets types from day one without implementations. 95% of instruments, curves and indexes preloaded and ready to use.

-

Streamline the work between areas by digitizing contracts, validations and confirmations.

-

Centralizes and automates treasury and accounting tasks. Configures internal controls to mitigate errors. Meet regulatory compliance.

YOUR TEAM DESERVES THE BEST